How to Get Insurance to Pay for Your Water Damage

Water damage restoration can be expensive. However, if it is covered by your insurance, you may not have to foot that bill. Let’s take a closer look.

Water damage is extremely common. Nearly a quarter of homeowners insurance claims deal with water damage. If you have recently experienced water damage, or if you are simply preparing for the possibility of this event in the future, we’d like to help you understand how homeowners insurance often works in relation to water damage. Knowing what your policy covers and what it does not, you can make timely and appropriate decisions should an issue arise.

Which Type of Water Damage Is Covered?

Some, but not all types of water damage are likely to be covered by your homeowners insurance policy. It is important to point out that every policy is different, and consulting your own policy is the best way to know exactly what is covered in your case. We will give you some general guidelines and common coverage situations, but you’ll never know for sure unless you check your policy directly. If you have trouble reading the document, contact your insurance agent and ask specifically about water damage and what will be covered in your case. Typically, it is sudden and accidental water damage that will fall under the covered category in your policy. A great example of this type of damage is a water heater that bursts unexpectedly. Such an event could obviously cause tremendous water damage, and the restoration work required after that damage is likely to be covered.

So, with that out of the way, what kinds of water damage are covered by homeowners insurance policies? Typically, it is sudden and accidental water damage that will fall under the covered category in your policy. A great example of this type of damage is a water heater that bursts unexpectedly. Such an event could obviously cause tremendous water damage, and the restoration work required after that damage is likely to be covered.

Notable Exceptions

With any luck, the water damage that has been sustained by your home will be covered by insurance. However, not all types of damage is covered, so don’t just assume that any damage caused by water will be paid for by the insurance company. Specifically, damage that is caused by water over a long period of time is unlikely to be covered. This can be an unwelcome surprise for a homeowner, so be sure to monitor your home for water leaks and address them right away.

Performing needed maintenance on all components of the water system that serves your home is particularly important when you consider the damage done by wear and tear may not be covered. If you fail to address a small leak, and the water from that small leak does major damage over time, you’ll be on your own to pay for the repair work. In addition to the damage that can be done by a small leak in a pipe, there are other examples to consider in this category such as:

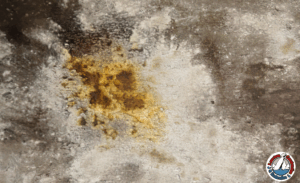

- Water seeping in through cracks in your basement could eventually lead to mold and other forms of damage

- Roofing issues such as: loose shingles, missing tiles, and insufficient flashing can cause slow water damage over time

- Poor repair work for other home maintenance issues can allow water to enter the building

Another category of water damage that won’t be covered by a standard homeowners insurance policy is flood damage. If a flood moves into your area and the water enters your home, the damage done by the rising water is not going to fall under your standard coverage. With that said, you may want to secure a separate flood insurance policy to cover flooding. If you know that flooding is possible in your area, reach out to your insurance company for more information on policy options that may be available.

Filing a Successful Claim

In the aftermath of a water damage event, your mind will quickly turn to how you will get the damage fixed, and how you will pay for the repairs. If you think the damage should be covered by your policy, you will want to file a claim as quickly as possible. To give your claim the best possible chance of being approved, consider the tips below:

- Document everything. Perhaps the best thing you can do after the water damage occurs is to carefully document what has happened. Take photographs of everything related to the event, including where the water was coming from, what has been damaged, and anything else relevant to the claim. Having pictures to file along with your claim will go a long way towards expediting the process.

- Stop the damage from getting worse. You don’t want to let anything get worse while you are waiting for the approval of your claim. Stop the water from leaking and do light cleanup work (while always keeping in mind that safety should be your top priority). Even if you are confident that your claim will be approved, don’t just leave every last bit of work for a contractor to do later on. Anything you can do in the meantime will make it easier for your home to be returned to its previous condition.

- Use the right contractor. Assuming you will need help with the repair work that is required to recover from this event, pick a professional team that has experience working with insurance companies. A partner like Lawton will be able to deal with the insurance companies to make sure the appropriate details are submitted so the claim can proceed properly.

- Save every receipt. It will be pretty easy to document the money that is paid to a contractor, but don’t forget to keep track of everything else you spend on this project. For example, if you run to the local home store to buy supplies, keep that receipt and submit it as part of your claim. Even for purchases that seem rather small, you might as well hold onto the receipt and get reimbursed for as much as possible.

As long as your water damage is in fact covered by your insurance policy, you shouldn’t have too much trouble getting the claim approved. That’s particularly true when you work with Lawton Construction & Restoration to evaluate the damage, determine the necessary repair work to be done and the associated cost.

What to Do If Your Water Damage Claim is Denied

It’s possible that your claim can be denied, despite your best efforts to provide all the necessary information to the insurance company. If this happens, your first course of action is to reach out directly to the company for more information. Ask them why the claim was denied. If this type of damage doesn’t fall under your coverage, there won’t be much else you can do. However, if the claim was denied simply because of a missing piece of documentation, you can take care of that error and submit it again. You don’t need to take no for an answer without at least receiving more information and determining if there is anything else you can do.

Planning Ahead

In the aftermath of a water damage event, it is worth taking some time to assess your coverage and think about whether you’d like to adjust your policy moving forward. Are there additions you can make to your coverage that will put you in a better spot if another water damage issue comes up? It’s easy to take insurance policies for granted, but they are worth assessing from time to time just to be sure they cover all the things that could take place around your home.

Work with the Right Team

If your home has already suffered water damage, and you need repair work to start immediately, contact Lawton today. We have the experience necessary to take care of your project from start to finish, and we know how to work with insurance companies to get claims approved promptly.

Who We Are

Lawton Construction & Restoration. Proudly serving in North California & Nevada since 1976.

Turnkey services: Emergency, Restoration, Content Care

All levels of complexity: Residential, Comercial, Industrial

Fast interaction with all insurance companies.