What Happens After We Submit Our Estimate to Fire Damage Insurance?

Table of Contents

Introduction

Fire damage can be overwhelming, leaving you wondering what to do next to get your property back and life normal. Once you’ve submitted your fire damage estimate to insurance, what happens next? How long will it take? Will they pay for everything?

Navigating this process requires patience and information. At Lawton Construction & Restoration Company we know how important clear communication is during difficult times. Our commitment to safety and fire protection solutions expertise means you have the support you need every step of the way.

In this post we’ll walk you through the entire process – from insurance review to payment – so you can feel confident with each step. Ready to get started? Let’s go.

1. Insurance Review Process

After submitting your estimate to fire damage insurance, the waiting game begins. But what exactly happens behind the scenes? Understanding the insurance review process can help you manage expectations and avoid unnecessary stress.

Assessment of the Estimate

Once your estimate is received, the insurance company begins a detailed assessment. They’ll evaluate every line item, comparing it to industry standards to ensure accuracy and fairness. Their goal? To verify that the costs are reasonable and necessary for restoring your property to its pre-loss condition. This thorough review is a crucial part of their commitment to safety and maintaining reliability in the claims process.

Documentation Verification

Your estimate isn’t just about numbers—it’s backed by detailed documentation. This includes photos of the damage, receipts for emergency repairs, and records of any temporary living expenses. The insurance company meticulously reviews these documents to ensure everything aligns with the estimate provided. This step is essential to prevent discrepancies and speed up the approval process.

Comparing with Industry Standards

Insurance adjusters don’t work in isolation. They rely on industry standards and pricing guidelines to compare your estimate with typical costs for similar repairs. This comparison helps them determine if the requested amount is reasonable and aligns with current market rates. It’s their way of ensuring both you and the insurer receive a fair outcome.

Why Understanding This Process Matters

Knowing what happens during the review stage empowers you to be proactive. By ensuring your estimate is detailed and well-documented, you can reduce delays and minimize back-and-forth communication. Plus, it gives you the confidence to ask informed questions, helping you stay one step ahead throughout the claims journey.

At Lawton Construction & Restoration Company, we leverage our expanded expertise to create accurate, comprehensive estimates that align with industry standards. Our trusted team works closely with you and your insurance adjuster, ensuring a smoother and more efficient review process.

Wondering what comes next after the review? Let’s move on to how communication with the insurance adjuster plays a pivotal role in your claims experience.

2. Communication with the Insurance Adjuster

Submitting your estimate is just the beginning. Effective communication with your insurance adjuster is key to moving your claim forward. But how do you ensure smooth interactions without getting lost in industry jargon or endless back-and-forth emails? Let’s break down the communication process, so you know exactly what to expect and how to stay in control.

Initial Response Time

After submitting your estimate, the waiting period can feel like an eternity. So, when can you expect to hear back? Typically, insurance companies aim to acknowledge receipt of your estimate within a few days. However, the timeline for a detailed response can vary depending on the complexity of the claim.

To stay proactive:

- Follow up after a week if you haven’t received any confirmation.

- Be polite but firm in your communication, emphasizing your eagerness to move forward.

- Keep all communications documented—emails, call logs, and even text messages can be valuable later on.

At Lawton Construction & Restoration Company, we understand the importance of timely communication. Our trusted team stays in close contact with adjusters to help expedite the process, ensuring you receive updates as soon as they’re available.

Addressing Follow-up Questions

Once the adjuster reviews your estimate, they might have follow-up questions or requests for additional information. This is a normal part of the process, as they seek to clarify details before moving forward.

Common requests include:

- Breakdowns of specific costs (e.g., labor vs. materials)

- Additional photos or videos of the damage

- Receipts or proof of purchase for high-value items

To make this easier:

- Be prepared with detailed records and documentation.

- Respond promptly to avoid delays in the review process.

- Stay organized by maintaining a dedicated folder—digital or physical—for all claim-related documents.

Our team’s commitment to customer service means we’re always ready to assist you in gathering and submitting any additional information the adjuster might need.

Providing Additional Evidence

Sometimes, words on paper aren’t enough. If the adjuster has doubts about the extent of the damage or the necessity of certain repairs, providing additional evidence can help justify your estimate. This might include:

- Detailed photos showing the damage from multiple angles

- Videos that capture the scope of the damage more comprehensively

- Expert assessments from fire and life safety professionals to support your claims

Our expanded expertise allows us to supply the right evidence, helping you build a strong case and reinforcing the reliability of your estimate.

Why Effective Communication Matters

Clear and consistent communication not only speeds up the claims process but also helps build trust. It demonstrates your commitment to transparency and ensures that misunderstandings are minimized. By staying organized, responsive, and proactive, you pave the way for smoother negotiations and a quicker resolution.

At Lawton Construction & Restoration Company, we prioritize effective communication, bridging the gap between homeowners and insurance adjusters. Our team’s dedication to safety and customer service ensures you’re never left in the dark, keeping you informed every step of the way.

Ready to see what happens next? In the following section, we’ll dive into the adjuster’s inspection and how to prepare for this crucial step in the claims process.

3. The Adjuster’s Inspection

You’ve submitted your estimate and navigated the initial communication with your insurance adjuster. Now comes one of the most critical steps—the adjuster’s inspection. But what exactly does this involve, and how can you ensure the inspection works in your favor? Knowing what to expect and how to prepare can make all the difference in the outcome of your fire damage claim.

On-Site Evaluation: What to Expect

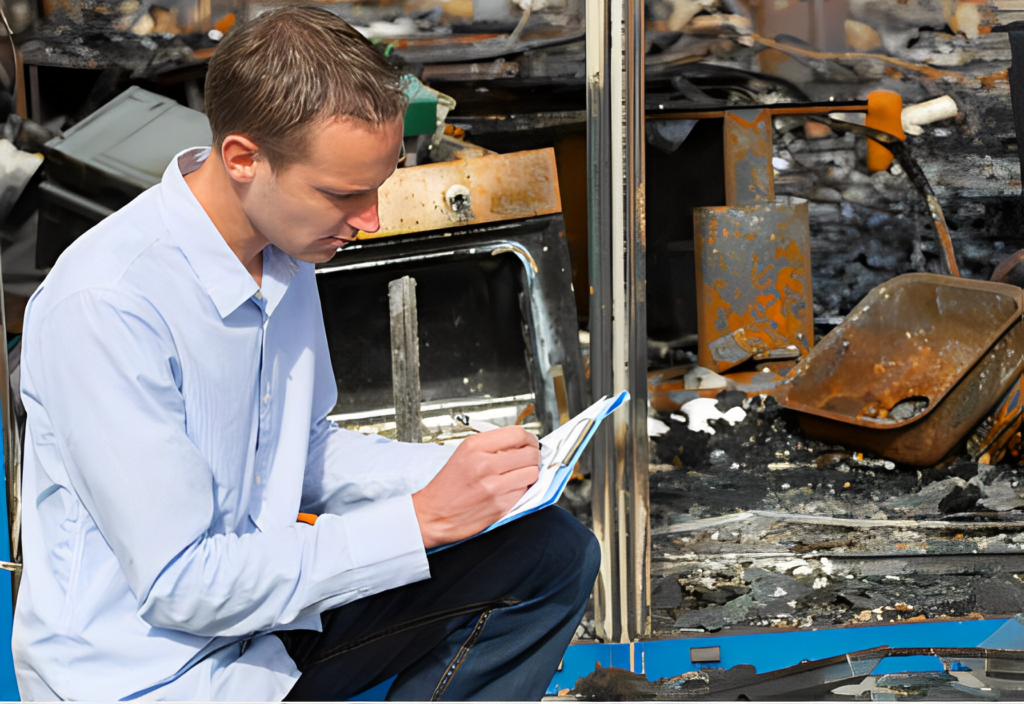

During the inspection, the insurance adjuster will visit your property to assess the damage firsthand. They’ll verify the information in your estimate, taking their own photos, measurements, and notes. This allows them to gauge the scope of work needed for repairs accurately.

Expect the adjuster to:

- Inspect all affected areas, even those you might not think are damaged.

- Take detailed photos and videos to document the extent of the damage.

- Ask questions about the events leading up to the fire and any emergency repairs you’ve already made.

Pro tip: Be honest and transparent in your responses. Trying to exaggerate damages or withhold information can backfire, leading to delays or even claim denial.

Collaborating with Contractors

Having your contractor present during the inspection can be incredibly beneficial. They can clarify any technical details and provide expert insights that might not be immediately apparent to the adjuster. At Lawton Construction & Restoration Company, our trusted team is always ready to collaborate, ensuring the adjuster fully understands the scope of work needed.

Why this matters:

- Accurate Scope of Work: Contractors can point out hidden damage that might be overlooked.

- Cost Justification: They can explain why certain repairs or materials are necessary, supporting the estimate’s accuracy.

- Faster Resolution: Clear communication between the adjuster and contractor helps avoid misunderstandings, speeding up the approval process.

Negotiating the Scope of Work

Sometimes, the adjuster might question the necessity of certain repairs or suggest alternatives. This is where negotiations come into play. It’s essential to be prepared to defend your estimate while staying open to reasonable adjustments.

Tips for effective negotiation:

- Stay calm and professional, focusing on facts rather than emotions.

- Use evidence, such as expert assessments or industry standards, to justify your claims.

- Be flexible, but ensure any agreed-upon changes still meet safety and quality standards.

Our commitment to safety and reliability means we advocate for the necessary repairs to restore your property to its pre-loss condition, without cutting corners. Our team’s expanded expertise allows us to negotiate confidently, ensuring you get the coverage you deserve.

How to Prepare for the Inspection

Preparation is key to a successful inspection. Here’s how you can make the process smoother:

- Organize all documents related to the damage, including photos, receipts, and temporary repair invoices.

- List all affected areas, even if the damage seems minor. Smoke and water damage can be more extensive than they appear.

- Ensure access to all areas, including the attic, basement, and crawl spaces, so the adjuster can conduct a thorough inspection.

- Be present during the inspection to answer questions and provide context for the damage.

At Lawton Construction & Restoration Company, we guide you through the preparation process, ensuring nothing is overlooked. Our commitment to customer service and clear communication helps you feel confident and in control throughout the inspection.

Why This Step Matters

The adjuster’s inspection plays a crucial role in determining the outcome of your fire damage claim. A well-documented, accurate assessment sets the foundation for a fair settlement. By being proactive and prepared, you can ensure that all damages are accounted for, reducing the risk of disputes or delays.

Ready to learn what happens next? In the following section, we’ll explore how insurance companies handle approvals, negotiations, or rejections of your estimate, and what steps to take in each scenario.

4. Approval, Negotiation, or Rejection of the Estimate

After the adjuster’s inspection, the insurance company faces a crucial decision—whether to approve, negotiate, or reject your estimate. This stage can feel like an emotional roller coaster, but knowing what to expect helps you navigate it with confidence. Let’s explore each possible outcome and the best way to respond.

When the Estimate Is Approved

Congratulations! If your estimate is approved, it means the insurance company agrees with the scope of work and costs you’ve submitted. But what happens next?

Here’s what to expect:

- You’ll receive an approval notice, usually via email or postal mail, detailing the accepted amount and the terms of the payout.

- The payout may come in a lump sum or in stages, depending on the size of the claim and your policy terms.

- Your contractor can now begin the restoration process, knowing that the necessary funds are secured.

Pro tip: Before starting any work, review the approval notice carefully to ensure all damages and repairs are accounted for. If something is missing, now is the time to address it.

At Lawton Construction & Restoration Company, we prioritize transparency and customer service, ensuring you fully understand the approval and payout process. Our trusted team is ready to start restoring your property as soon as the green light is given.

If Negotiation Is Needed

Sometimes, the insurance company may approve part of your estimate but dispute certain costs or repairs. This doesn’t mean they’re unwilling to pay—it just means more clarification is needed.

Common reasons for negotiation include:

- Discrepancies in material or labor costs compared to industry standards.

- Questions about the necessity of certain repairs or the scope of work.

- Alternative repair methods suggested by the insurer that may be cheaper but not always ideal.

How to handle negotiations:

- Stay calm and professional, focusing on facts rather than emotions.

- Present additional evidence—such as expert assessments or quotes from other contractors—to justify your claims.

- Be flexible, but ensure any adjustments still meet safety and quality standards

Our expanded expertise in fire and life safety allows us to negotiate effectively on your behalf. We understand industry pricing and the importance of using reliable materials and methods, ensuring your property is restored safely and efficiently.

Dealing with Rejection

A rejected estimate can be disheartening, but it’s not the end of the road. Insurance companies typically provide a detailed explanation for the rejection, giving you the opportunity to appeal or revise your estimate.

Here’s how to respond:

- Review the rejection notice carefully to understand the insurer’s reasons.

- Gather additional evidence to support your estimate, such as:

- Expert assessments or second opinions from industry professionals.

- Photos or videos that better illustrate the damage.

- Documentation of code requirements that justify the repairs.

- Request a re-evaluation or appeal the decision by submitting a revised estimate with the additional evidence.

- Consider mediation or legal action if the insurer remains uncooperative, especially if the rejection seems unfair or unfounded.

At Lawton Construction & Restoration Company, we support you every step of the way. Our commitment to safety and customer service means we don’t back down easily. We’re prepared to advocate for the repairs needed to restore your property to its pre-loss condition.

Why This Stage Matters

The approval, negotiation, or rejection stage is pivotal in the claims process. How you respond can significantly impact the final payout amount and timeline. Being well-prepared, organized, and proactive gives you the best chance of a positive outcome.

Our team’s reliability and dedication to customer satisfaction mean you’ll never face this process alone. We work closely with you and the insurance adjuster, ensuring a fair and transparent resolution.

Ready to learn about the final stage of your fire damage claim? In the next section, we’ll explore how to handle the insurance payout and use it effectively for restoration.

5. Receiving and Using the Insurance Payout

After navigating the complexities of estimate reviews, inspections, and negotiations, the moment you’ve been waiting for finally arrives—receiving your insurance payout. But how do you make the most of these funds to restore your property efficiently and effectively? Understanding how the payout works and planning strategically can save you time, money, and stress.

How the Payout Is Issued

Insurance payouts for fire damage claims aren’t always straightforward. The way you receive the funds largely depends on your policy and the size of your claim. Here’s what to expect:

- Lump-Sum Payment: Smaller claims are often paid out in one lump sum, allowing you to start repairs immediately.

- Multiple Installments: For larger claims, the payout might be issued in stages, aligned with the progress of the restoration work.

- Checks Issued to Both You and Your Mortgage Lender: If you have a mortgage, the check may be made out to both you and your lender. This is because the lender has a vested interest in ensuring the property is properly repaired.

Pro tip: If your payout includes your mortgage lender, contact them to understand their process for endorsing and releasing the funds. This can prevent unnecessary delays.

At Lawton Construction & Restoration Company, we provide clear guidance on navigating these financial logistics, ensuring you’re never left guessing. Our commitment to customer service means we’re here to answer any questions you might have about the payout process.

Prioritizing Repairs and Restoration

Once you have the funds, the next step is deciding how to allocate them effectively. It can be tempting to dive right into renovations, but strategic planning is crucial to staying within budget and timeline constraints.

Start by prioritizing repairs that:

- Address safety concerns—such as structural stability, electrical systems, and fire protection solutions.

- Prevent further damage—including roof repairs, water damage mitigation, and mold prevention.

- Restore essential living areas—like the kitchen, bathroom, and bedrooms.

By focusing on safety and functionality first, you ensure that your property is both habitable and protected against future issues. Our expanded expertise in fire and life safety allows us to help you prioritize effectively, ensuring all critical repairs are addressed promptly.

Working with Your Contractor

Choosing the right contractor is vital to making the most of your insurance payout. You need a trusted team that not only understands the restoration process but also has experience working with insurance companies.

Here’s how to maximize collaboration:

- Communicate openly about your budget, timeline, and expectations.

- Request a detailed work schedule that aligns with your insurance payout stages.

- Keep track of expenses and receipts to stay within budget and document all costs for final reporting to your insurer.

At Lawton Construction & Restoration Company, we pride ourselves on transparent communication and reliability. Our team works closely with you to create a customized restoration plan that meets your needs without compromising on quality or safety.

Handling Unexpected Costs

Even with a well-planned estimate, unexpected costs can arise during the restoration process. This might include:

- Hidden structural damage uncovered once repairs begin.

- Code upgrades required by local regulations.

Material price fluctuations due to market changes.

To manage these surprises:

- Set aside a contingency fund, typically 10-15% of the total budget, to cover unexpected expenses.

- Communicate with your contractor immediately if costs start to exceed the initial estimate.

- Contact your insurance adjuster to determine if additional funds are available, especially for code-related upgrades.

Our team’s expertise and commitment to safety ensure that unexpected challenges are addressed efficiently, minimizing disruptions and keeping your project on track.

Finalizing the Claim

Once all repairs are completed, it’s time to close out your claim. This involves:

- Completing a final walkthrough with your contractor to confirm that all work is completed to your satisfaction.

- Submitting a final report to your insurance company, including receipts, invoices, and any necessary documentation.

- Requesting the final payment if your payout was issued in stages.

At Lawton Construction & Restoration Company, we guide you through this final stage, ensuring all paperwork is accurate and submitted promptly. Our dedication to customer service means you’ll never feel lost in the process.

Why This Stage Matters

Receiving and effectively using your insurance payout is the culmination of your fire damage claim journey. It’s where all the preparation, negotiation, and planning come together to restore your property and bring you peace of mind. By staying organized and strategic, you can maximize the value of your insurance payout and ensure a successful restoration.

Ready to move forward with confidence? At Lawton Construction & Restoration Company, our trusted team stands by your side from start to finish. Contact us today to learn more about our reliable fire protection solutions and how we can support you throughout the insurance claim and restoration process.

Conclusion: Navigating Fire Damage Claims with Confidence

Dealing with the aftermath of a fire is challenging, but understanding the insurance claim process can make the journey to recovery smoother and more manageable. From submitting your estimate to working with adjusters, negotiating payouts, and finally restoring your property, each step is crucial to getting the compensation you deserve. But you don’t have to face it alone.

At Lawton Construction & Restoration Company, we’re more than just a restoration service—we’re your trusted partner every step of the way. Our commitment to safety, reliability, and exceptional customer service ensures that your property is restored efficiently and effectively. With our expanded expertise in fire and life safety, you can be confident that your home or business is in capable hands.

Are you ready to take the next step in your recovery journey? Whether you’re just starting the claims process or need help with restoration, our team is here to support you. Contact Lawton Construction & Restoration Company today and let us help you rebuild not just your property, but your peace of mind.

Your recovery matters to us—let’s restore what’s important together.